Think of a DEX aggregator as your crypto shopping assistant. It looks through multiple decentralized exchanges at once, kind of like how some flight booking apps or websites search different airlines, to help you get the absolute best deal on your crypto trades. Crypto DEX aggregators enable users to optimize their trades efficiently by pulling data from several sources. These are important in the cryptocurrency world since they provide users with a unified interface for access to the liquidity pools of numerous exchanges. Understanding the technical intricacies behind successful DEX aggregators is important for businesses looking to dominate this space.

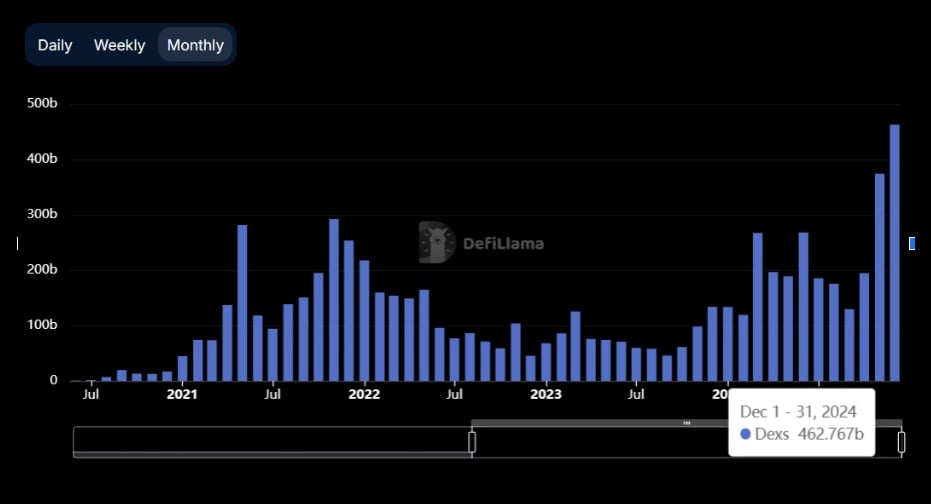

- According to the data released by DefiLlama on 30 December 2024, DEXs experienced a record-breaking monthly trading volume of $462 billion.

- On 17 Jan 2025, the total volume locked on DEXs in 24 hours was $12.299b.

This article explores five key technical secrets that make a decentralized exchange aggregator successful, focusing on the nuances of DeFi exchange development and cross-chain functionality.

SECRET #1: Smart Order Routing: The Algorithmic Heart

At its core, a DEX aggregator needs incredibly sophisticated smart order routing algorithms. This isn’t just about comparing prices across multiple DEXs; it’s about understanding the nuanced mechanics of each platform. The algorithm must consider several critical factors:

- Slippage: DEXs rely on automated market makers (AMMs), which can experience price slippage, particularly during large trades. A good algorithm doesn’t simply target the lowest initial price; it projects how the price will change throughout the trade execution, splitting orders across multiple pools when necessary to minimize slippage. These calculations often involve complex mathematical models.

- Gas Costs: Transaction fees (gas) on blockchains, notably Ethereum, can be substantial. Excessive gas fees might negate a naive approach to finding the best price. The algorithm needs to intelligently weigh the trade-off between price and gas, choosing a route that delivers the best net result for the user. A poorly programmed routing algorithm, especially during periods of network congestion, can even end up costing users more than they would have paid using a single DEX.

- Token Pairs and Liquidity: Not all DEXs support all token pairs. The algorithm needs to be aware of the available liquidity in each DEX for the desired trading pair. It should dynamically adjust its pathfinding based on real-time liquidity data to avoid failed transactions.

- Transaction Speed: Speed is paramount in volatile cryptocurrency markets. The routing algorithm must be optimized for rapid execution, considering the varying block confirmation times across different blockchains. This might involve parallelizing trades or using batching techniques.

Successful crypto DEX aggregators invest heavily in constantly refining these routing algorithms, often using simulations and machine learning to iteratively improve performance. They must be adaptable, continuously learning from market conditions and evolving to account for new DEX protocols.

SECRET #2: Real-Time Data Aggregation and Management

The intelligence of a DEX aggregator relies on up-to-the-minute, accurate data. This necessitates a robust and efficient data aggregation system that can pull information from various sources, including:

- On-Chain Data: Gathering transaction data directly from blockchain nodes is crucial for tracking liquidity pool sizes and real-time pricing. This requires highly optimized blockchain indexing capabilities and the ability to handle vast amounts of data.

- DEX APIs: DEXs often provide APIs that offer price feeds and other valuable information. The aggregator must seamlessly integrate with these APIs, handling variations in formats and access methods.

- Price Oracles: Relying on external price oracles for accurate price data can provide an additional layer of security and reliability, particularly in volatile market situations.

- Global Caching: Caching of frequently used data globally helps reduce latency and improves overall performance, especially during peak usage periods.

The challenge lies in processing this diversified data stream in real-time and transforming it into a format useful for the routing algorithm. This requires a sophisticated data pipeline capable of robust error handling and data validation so as not to have incorrect information influencing trade decisions. The speed and accuracy of data aggregation separate the good decentralized exchange aggregator from the mediocre.

SECRET #3: Cross-Chain Compatibility: Expanding Reach & Opportunity

As the DeFi landscape spreads across Layer-1 and Layer-2 blockchains, it is now highly necessary for decentralized exchange development firms to focus on cross-chain functionality. At the same time, a cross chain DEX aggregator should be able to tap into the liquidity of several chains. This will thus provide users with significantly more trading opportunities and better prices.

To enable this cross-chain capability, significant technical hurdles must be overcome:

- Bridging Technologies: The aggregator needs to integrate with various cross-chain bridges, which are responsible for transferring tokens between different networks. Each bridge has its own unique architecture, security considerations, and latency characteristics.

- Transaction Atomicity: Ensuring that cross-chain trades are executed atomically (all parts are executed or none) is crucial to prevent the loss of funds. This calls for complex coordination between bridges and DEXs on different chains through mechanisms such as multi-sig and locking mechanisms.

- Smart Contract Interoperability: The aggregator’s smart contracts should be designed to interact seamlessly with smart contracts on other blockchains, accommodating variations in code and data formats. This interoperability is the foundation of a cross chain DEX aggregator.

- Gas Management Across Chains: Managing gas fees across multiple chains can be complex, requiring the aggregator to dynamically calculate and present the total cost to the user.

SECRET #4: Secure and Audited Smart Contracts

Ensuring the security of a decentralized exchange aggregator is absolutely necessary. As it handles user funds and facilitates trading activity, its smart contracts are a prime target for exploits. Therefore, rigorous security practices are critical throughout the development lifecycle, including:

- Formal Verification: The method adopts formal verification techniques mathematically to prove the correctness of smart contract code, eradicating bugs and vulnerabilities.

- Comprehensive Audits: For detecting potential security flaws that can be rectified, it is fundamental to have an independent security audit by reliable blockchain security firms.

- Continuous Monitoring: Implementing real-time monitoring systems can be used to alert of abnormal transaction activity and thus prevent harmful actors from using opened vulnerabilities.

- Immutable Code: Once a production-ready smart contract has been deployed, it should be immutable, meaning that once the code has been set, it should not change. This ensures the rules governing the system remain transparent and tamper-proof.

DeFi Exchange Development requires a strong commitment to security best practices. Neglecting these practices will almost certainly compromise the entire system.

SECRET #5: Scalability and Performance Optimization

As the DeFi ecosystem expands, crypto DEX aggregators need to scale according to the number of users and transactions to be supported.

- Efficient Database Architecture: The decentralized exchange aggregator’s database architecture needs to be optimized for high query volumes and real-time data ingestion. This may involve using distributed databases and sharding techniques.

- Load Balancing: It would ensure the ability of the platform to withstand user loads that might cause significant performance degradation without any drop.

- Code Optimization: Keeping the code extremely resource-optimized was a prime prerequisite to maintaining constant performance levels over time, mostly when the network is congested.

- Advanced Caching Strategies: Deploying in-memory caching and CDN for caching static data enormously accelerate computations for trade quantities.

Decentralized exchange development and optimization techniques must be a continuous process in order to maintain a high level of performance.

3 Interesting Facts About DEX Aggregators

1. They’re like Flight Comparison Websites for Crypto

Just like websites that scan multiple airlines to find the cheapest flight, crypto DEX aggregators don’t hold your crypto themselves. Instead, they connect to numerous decentralized exchanges and search for the best prices and routes for your trades. This means they can often find you a better deal than using a single DEX directly, saving you on slippage and maximizing the value of your swaps. They essentially streamline the fragmented world of DeFi and make it more accessible.

2. They Don’t Just Find the Best Price, They Optimize Routes

It’s not only a matter of getting the best price for a single swap. A decentralized exchange aggregator often has sophisticated algorithms to “split” trades across multiple DEXs and even multiple liquidity pools within those DEXs. This will minimize the effect of large orders on the price (slippage) as it distributes it across various sources. It is, in a sense, an intelligent delivery service, finding the best path for your package to be delivered, even if it crosses several warehouses on the way. Such a fine route optimization is one of the advantages of using aggregators.

3. They are Powerful Tools for Arbitrage Opportunities

Crypto DEX aggregators, while primarily meant to help users find better prices, also inadvertently play a role in arbitrage. Because they constantly scan multiple markets for price differences, they can trigger trades that bring prices closer together. This can not only increase market efficiency but also reduce the size of arbitrage opportunities for bots with sophisticated strategies. In a way, they can help level the playing field by making it easier for more users to benefit from price discrepancies that might have previously been exploited only by high-frequency traders.

Wrap Up

Building a successful DEX aggregator is not merely about aggregating price data. It requires a deep understanding of complex algorithms, data management, cross-chain interoperability, security best practices, and scalability principles. The five technical secrets outlined above highlight the intricacies involved in creating a high-performing and reliable tool for the DeFi community.

Antier, a DeFi exchange development specialist can help build a cross chain DEX aggregator with a strong focus on scalability, security, and performance. We ensure that your platform can seamlessly integrate with various blockchain networks, offering users a comprehensive and efficient trading experience.

Reach out today!