“In the world of crypto derivatives, stability is the rarest currency.”

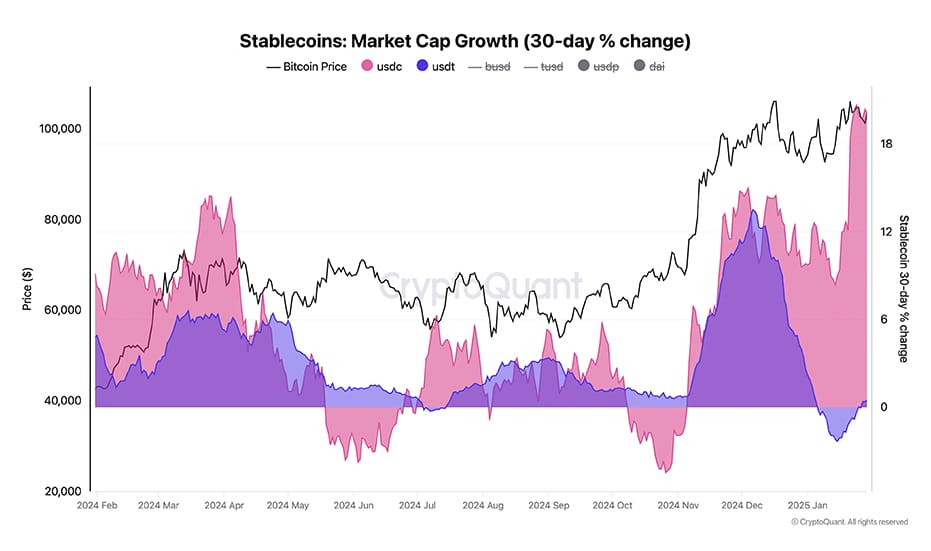

The crypto derivatives market has experienced significant growth, with monthly volumes reaching $1.33 trillion as of September 2023, surpassing the spot market. Stablecoins have become integral to this expansion, serving as a core settlement layer in digital finance. Their record supply growth and increasing transaction volumes underscore their pivotal role in facilitating liquidity and stability within crypto derivative exchanges. Institutional investors and fintech enterprises are increasingly investing in crypto derivative exchange development solutions that incorporate stablecoin integration. Stablecoins have grown by almost $40 billion since President Trump won the U.S. election, with a market cap of over $200 billion. The stability and liquidity offered by stablecoins make them an attractive asset for creating a crypto derivative exchange.

This global trend further highlights the growing importance of stablecoins in the crypto derivatives market. As the regulatory environment becomes more defined, particularly with frameworks like the EU’s Markets in Crypto-Assets (MiCA), businesses are positioning themselves to leverage the benefits of stablecoin integration in derivative exchanges. This strategic alignment is anticipated to drive further innovation and investment in the sector. For businesses, stablecoin integration in crypto derivatives is not just a trend—it’s an essential step in ensuring market efficiency, compliance, and scalability in an increasingly regulated and sophisticated trading ecosystem. With the regulatory landscape evolving, investing in this cutting-edge infrastructure is not only a necessity but a long-term advantage in capturing institutional trust and driving sustainable market growth.

Role of Stablecoins in Crypto Derivative Exchange Trading

Volatility continues to be the most formidable adversary in crypto derivative exchange trading, exposing traders to unpredictable price swings, margin inefficiencies, and collateral instability. This systemic turbulence often leads to forced liquidations, disjointed price discovery, and capital inefficiencies. The integration of stablecoin in cryptocurrency derivative exchange development solution serves as a financial stabilizer, mitigating systemic shocks by offering a reliable settlement layer with low-latency finality. Their algorithmic precision ensures that margin collateral remains resistant to market fluctuations, fortifying risk-adjusted strategies within crypto derivative exchange development solutions.

Furthermore, stablecoin liquidity bolsters capital efficiency, enabling seamless on-chain and off-chain derivatives execution. Institutional traders leverage these assets to construct advanced hedging mechanisms, minimizing exposure to extreme market dislocations. As regulatory frameworks evolve, the adoption of stablecoins is redefining how market participants create a crypto derivative exchange that prioritizes both stability and high-frequency transactional integrity within the crypto derivatives ecosystem.

Business Advantages Of Stablecoin Integration In Crypto Derivative Exchange

Integrating stablecoins into crypto derivative exchanges offers several core technical benefits that enhance the trading experience. Are you planning to hire efficient crypto derivative exchange development services from an experienced blockchain firm? If yes, then you must definitely have an in-depth look at the advantages to make an informed decision-

✔ Enhanced Liquidity Provision- Stablecoins deepen order book liquidity, reducing bid-ask spreads and slippage risks. Their integration into a crypto derivative exchange development solution enables seamless capital deployment and institutional-grade order execution.

✔ Mitigation of Collateral Volatility- Stablecoins prevent margin erosion in leveraged trading by maintaining price stability. A crypto derivatives exchange development company ensures more reliable collateral management, minimizing unnecessary liquidations.

✔ Efficient Cross-Border Settlements- Stablecoins enable instant, low-cost global transactions, eliminating fiat settlement inefficiencies. Businesses that create a crypto derivative exchange with stablecoin integration benefit from frictionless capital flows.

✔ Seamless Integration with DeFi Protocols- Stablecoins bridge centralized exchanges with DeFi liquidity pools and yield-generating protocols. Cryptocurrency derivatives exchange development unlock hybrid financial opportunities for traders.

✔ Regulatory Compliance and Transparency- Stablecoins align with KYC/AML frameworks, ensuring compliance and fostering institutional trust. Crypto derivatives exchange development services incorporate stablecoin-backed transparent settlement mechanisms.

✔ Reduced Transaction Costs & Faster Settlements- Stablecoin transactions offer near-zero fees and real-time settlements, reducing trading costs in a crypto derivative exchange while improving capital efficiency.

✔ Stable & Predictable Margin Requirements- Stablecoins ensure consistent margin calculations, preventing unexpected margin calls. Crypto derivative exchange development solutions benefit from structured risk management.

✔ Improved Market Efficiency & Price Discovery- Stablecoins stabilize order books, enabling accurate price discovery. A crypto derivatives exchange development company enhances market efficiency with reduced arbitrage gaps.

✔ Greater Institutional Adoption & Trust- Stablecoins provide a reliable entry point for institutional investors. Businesses that create a crypto derivative exchange attract hedge funds and asset managers.

✔ Minimized Risk of Forced Liquidations- Stablecoins reduce forced liquidations in leveraged trading by providing predictable collateral. Crypto derivatives exchange development services ensure better capital preservation.

Incorporating stablecoins into crypto derivative exchanges not only addresses inherent challenges associated with volatility and liquidity but also aligns with the evolving landscape of digital asset trading, offering a more secure and efficient trading experience. Thus, you must get one designed for your business by associating with a renowned cryptocurrency derivative exchange development company. The companies boast a vast team of professional developers who help you design the best for you.

How To Create Crypto Derivative Exchange With Stablecoin Integration?

The exponential rise of crypto derivative exchanges has captured the attention of institutional investors and enterprises seeking exposure to sophisticated financial instruments in the digital asset space. However, navigating the complexities of crypto derivative exchange development requires more than just market enthusiasm—it demands a strategic understanding of the entire process. Understanding the complex development lifecycle is critical for investors and businesses looking to capitalize on this profitable sector. Now, let’s explore the strategic steps involved in developing a high-performance crypto derivative exchange with stablecoin integration.

Step 1. Comprehensive Market Analysis and Strategic Planning

The foundation of a successful crypto derivative exchange lies in meticulous market research and strategic foresight. This phase involves analyzing the demand for crypto derivatives, studying competitor platforms, and evaluating current regulatory landscapes. A deep understanding of liquidity requirements, margin trading mechanisms, and the role of stablecoins is essential in structuring an efficient exchange model. A well-defined roadmap ensures that the development aligns with market expectations, trading dynamics, and compliance standards. Partnering with a crypto derivatives exchange development company at this stage allows businesses to assess the technical feasibility of their envisioned platform, ensuring a strong foundation for long-term scalability and profitability.

Step 2. Architectural Design and Technological Framework Selection

Once the strategic plan is in place, the next step is to define the technological architecture. This involves selecting the right blockchain infrastructure, consensus mechanisms, and interoperability solutions to facilitate seamless trading. High-performance order matching engines, smart contract-based margin protocols, and real-time risk monitoring systems must be incorporated to enhance platform efficiency. For a cryptocurrency derivative exchange development solution, integrating stablecoins requires a specialized liquidity framework that ensures seamless conversion between assets while mitigating market volatility. The selection of smart contract frameworks, API integrations, and trading automation tools must be handled by professionals offering crypto derivatives exchange development services, ensuring that the exchange operates with institutional-grade performance and security.

Step 3. Development of Core Trading Engine & Stablecoin Integration

At the heart of a crypto derivative exchange is the trading engine, which facilitates order execution, margin trading, perpetual contracts, and liquidation mechanisms. This stage involves the development of HFT engines, AMM models, and sophisticated derivative contract settlements. The integration of stablecoins into the exchange plays a pivotal role in optimizing trading stability, reducing price fluctuations, and ensuring smooth collateralization processes. Developers implement smart contract-based escrow systems and liquidity pools to enable efficient stablecoin settlements across derivative trading pairs. Businesses aiming to create a crypto derivative exchange must ensure that the trading engine and stablecoin mechanisms work in sync to maintain market efficiency and financial security.

Step 4. Implementation of Security Protocols and Regulatory Compliance

Security and compliance are non-negotiable aspects of a crypto derivatives exchange development solution. Given the high-volume transactions and leverage mechanisms involved, the platform must be fortified with multi-layered security protocols, including encryption algorithms, multi-signature wallets, and cold storage asset management. Additionally, integrating compliance frameworks such as KYC and AML ensures regulatory adherence, preventing illicit activities, and safeguarding investor interests. Businesses engaging in cryptocurrency derivatives exchange development must work closely with legal experts and blockchain security firms to establish a regulatory-compliant and attack-resistant ecosystem.

Step 5. Rigorous Testing, Deployment, and Continuous Optimization

Before launching, the entire platform undergoes a series of rigorous testing phases, including performance testing, security penetration testing, and stress testing under simulated market conditions. Developers assess the platform’s scalability, latency, and trade execution efficiency to ensure a seamless user experience. Once all components are validated, the exchange is deployed in live market conditions, followed by continuous performance monitoring and optimization. Post-launch support from a crypto derivatives exchange development company is crucial in refining functionalities, implementing software updates, and enhancing trading features based on real-time market feedback.

Hiring skilled and certified experts for crypto derivatives exchange development services. It is instrumental in transforming a conceptual vision into a fully operational trading ecosystem. These specialized firms leverage cutting-edge blockchain infrastructure, institutional-grade security, and innovative financial mechanisms to develop a platform tailored to your business needs. By collaborating with seasoned professionals offering crypto derivatives exchange development services, businesses can eliminate technical barriers, streamline operations, and launch a robust exchange that meets both investor expectations and industry benchmarks.

Future Nexus: Stablecoins & Crypto Derivative Exchange

The future of stablecoin-powered crypto derivative exchanges lies in the convergence of advanced blockchain architecture and financial engineering, poised to revolutionize digital asset trading. As DeFi ecosystems continue their maturation, the integration of stablecoins will propel the next generation of crypto derivatives toward unparalleled scalability and institutional-grade liquidity. Market movements indicate a substantial shift toward algorithmic stablecoins, enabling faster settlements, lower slippage, and seamless cross-chain interoperability. These advancements will enhance the precision of risk models, facilitating real-time collateral adjustments and improving leverage ratios.

Additionally, the integration of AI-driven analytics with stablecoin-backed crypto derivative exchange will optimize trade execution and market forecasting, further accelerating adaptive market behaviors. With a strong foundation in blockchain scalability and regulatory frameworks, stablecoin-integrated derivative exchanges will define the future of secure, frictionless, and highly efficient crypto derivatives markets.

Hire Certified Experts For Crypto Derivative Exchange From Antier

Partner with Antier, a premium crypto derivative exchange development company, to leverage next-gen blockchain expertise. Our team of certified blockchain professionals excels at delivering high-performance, robust solutions tailored to the evolving crypto landscape. We offer a suite of specialized services, including:

- Architecting scalable, fault-tolerant crypto derivative exchange platforms

- Seamless stablecoin integration for liquidity optimization

- Smart contract development, auditing, and optimization

- Advanced risk mitigation and margin management algorithms

- Full regulatory compliance for KYC/AML protocols

At Antier, our certified experts are equipped with unparalleled industry insights and technical prowess, ensuring the rapid delivery of high-impact solutions with unmatched precision. Trust us to accelerate your cryptocurrency derivative exchange development, enabling you to lead in a volatile market.